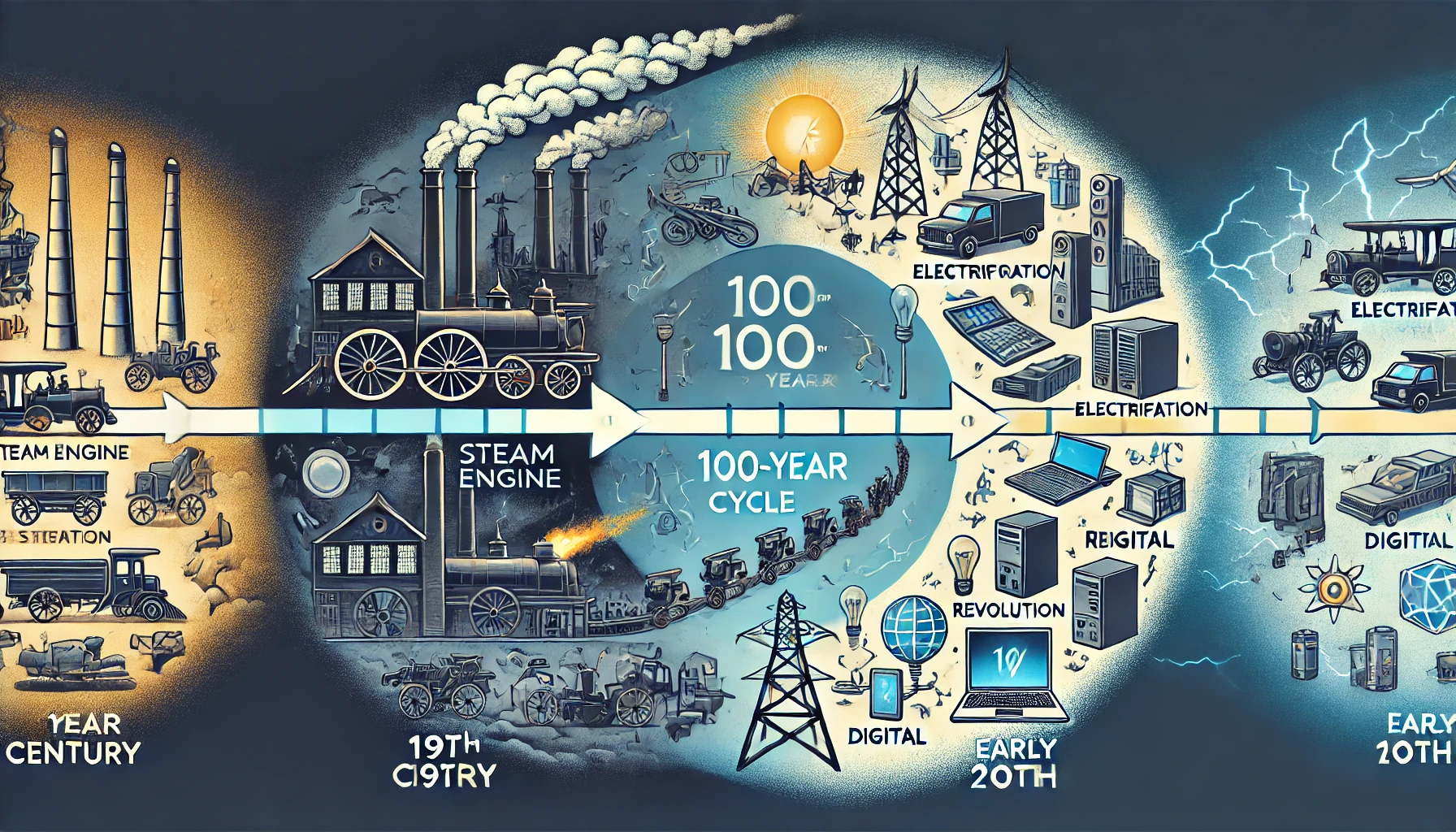

In the grand tapestry of human history, few patterns stand out as starkly as the interplay between technological revolutions and economic cycles. Over the past few centuries, we’ve seen the rise of transformative technologies, each driving profound changes in society. Interestingly, these major shifts often align with a roughly 100-year cycle, where technological breakthroughs are followed by economic disruptions—often recessions—before leading to long-term growth. This cycle isn't just a historical curiosity; it offers vital insights into our current age, where artificial intelligence (AI) seems poised to play a pivotal role.

The Steam Engine and the Industrial Revolution: 19th Century Beginnings

The first of these technological revolutions that we can clearly observe is the rise of the steam engine in the late 18th and early 19th centuries. This innovation powered the Industrial Revolution, fundamentally changing industries like textiles, transportation, and mining. The steam engine's ability to drive machines led to unprecedented productivity gains, but it also disrupted traditional industries and labor markets.

This period was not without economic turmoil. The early 19th century witnessed significant financial crises, such as the Panic of 1825, which saw economic contractions as societies grappled with the rapid changes brought by industrialization. Despite these challenges, the long-term effects of the steam engine were overwhelmingly positive, laying the foundation for modern industrial economies.

Electrification and the Second Industrial Revolution: The Early 20th Century

Fast forward about 100 years, and we find ourselves in the early 20th century, where electrification and the internal combustion engine were the new technological frontiers. This era, often referred to as the Second Industrial Revolution, saw the advent of mass production, assembly lines, and the widespread use of electricity in both industry and the home.

However, this period of rapid technological change also coincided with significant economic upheaval. The 1920s, known as the Roaring Twenties, were marked by economic prosperity driven by new technologies, but this boom was followed by the Great Depression of the 1930s. The economic collapse exposed the vulnerabilities and inequalities that had built up during the previous decades of technological change. Yet, in the aftermath, the continued adoption of these technologies played a crucial role in the economic recovery that followed, particularly during and after World War II.

The Digital Revolution: Late 20th to Early 21st Century

The late 20th century brought another wave of transformative technology with the advent of computers, the internet, and mobile devices. This Digital Revolution reshaped how we work, communicate, and live. The internet, in particular, has become the backbone of the modern economy, enabling the rise of globalized trade, digital platforms, and new business models.

This period, too, has seen its share of economic disruptions. The dot-com bubble of the early 2000s and the global financial crisis of 2008 both serve as reminders that rapid technological change can lead to speculative excesses and economic instability. Yet, as with previous cycles, these crises were followed by periods of adjustment and growth, with technology continuing to drive economic expansion.

Today’s Revolution: Artificial Intelligence and the Looming Economic Questions

Now, roughly 100 years after the Second Industrial Revolution, we stand on the brink of another transformative era, driven by artificial intelligence (AI). AI promises to revolutionize industries, from healthcare to transportation to finance. But, as history suggests, such profound technological change is likely to bring economic challenges alongside its benefits.

There is growing concern that AI could lead to significant job displacement, wage stagnation, and increased inequality—factors that could contribute to economic instability or even a recession. If the 100-year cycle holds, we might expect some level of economic upheaval as societies and economies adjust to this new technological paradigm.

The 100-Year Pattern: What Can We Learn?

The roughly 100-year cycle of technological revolutions and economic disruptions isn't a rigid rule, but it is a pattern worth considering. Each wave of innovation brings with it both opportunities and challenges. The key to navigating these cycles lies in our ability to adapt—to re-skill our workforce, rethink our economic models, and ensure that the benefits of new technologies are widely shared.

Looking ahead, the rise of AI and other emerging technologies will likely follow a similar trajectory: initial disruption, economic challenges, and, ultimately, long-term growth. By understanding this pattern, we can better prepare for the economic shifts that are likely to accompany the next wave of technological innovation.

As we observe the historical rhythm of technological revolutions every century, from the steam engine to electrification to the digital age, it becomes clear that each era of innovation brings profound changes to society and the economy. While these transitions are often marked by periods of economic distress, they also set the stage for the next phase of growth and development.

As we enter the age of AI, we would do well to remember the lessons of the past. By anticipating the challenges ahead and planning for a smooth transition, we can harness the power of this new technology to drive prosperity in the decades to come.

References:

- Perez, C. (2002). Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages. Edward Elgar Publishing.

- Kondratiev, N. D. (1935). The Long Waves in Economic Life. The Review of Economic Statistics, 17(6), 105-115.

- Brynjolfsson, E., & McAfee, A. (2014). The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies. W. W. Norton & Company.

- Gordon, R. J. (2016). The Rise and Fall of American Growth: The U.S. Standard of Living since the Civil War. Princeton University Press.