When the economy is booming, it feels like anyone can make money in the stock market. But what happens when the tide turns, and a recession looms on the horizon? It’s easy to feel anxious or uncertain, but with the right preparation, you can protect your finances and even uncover new opportunities during tough times. Here’s how to get ready.

1. Diversify Your Investments: Don’t Put All Your Eggs in One Basket

Imagine you’re standing in a beautiful orchard. Would you only pick apples and ignore the oranges, pears, and cherries? Of course not. In the world of investing, diversification is like harvesting from the whole orchard rather than just one tree.

When a recession hits, different types of investments react in different ways. While some stocks may plummet, bonds or commodities might hold their ground or even rise. By spreading your investments across various asset classes—like stocks, bonds, real estate, and commodities—you’re not overly dependent on one sector’s performance.

Table 1: one example explains potofolio average gain and max loss relations with different ratio of stock and bonds:

| Stock-to-Bond Ratio | Average Annual Gain (%) | Max Loss (%) |

| 100% Stocks / 0% Bonds | 10 | -50 |

| 80% Stocks / 20% Bonds | 8.5 | -40 |

| 60% Stocks / 40% Bonds | 7 | -30 |

| 40% Stocks / 60% Bonds | 5.5 | -20 |

| 20% Stocks / 80% Bonds | 4 | -10 |

| 0% Stocks / 100% Bonds | 2.5 | -5 |

During downturns, “defensive” sectors like consumer staples, healthcare, and utilities can be your safe havens. These are the industries that people rely on regardless of the economy. Think about it—no matter what’s happening in the world, people still need food, medicine, and electricity. Including these in your portfolio can provide a buffer against the storm.

2. Increase Cash Reserves: Build Your Financial Safety Net

Think of your cash reserves as the ultimate financial safety net. During prosperous times, it’s easy to get comfortable with a smaller emergency fund, but when recession hits, having a solid cash reserve can be a game-changer.

An emergency fund with enough to cover 6 to 12 months of living expenses isn’t just a nice-to-have; it’s a must. This cushion gives you the breathing room you need if you face a job loss, reduced income, or unexpected expenses. It’s your financial security blanket, allowing you to sleep easier at night knowing you’re prepared for whatever comes your way.

And let’s not forget liquidity. Having cash readily available means you can take advantage of opportunities that others might miss. When markets are down, and prices are low, those with cash on hand can snap up investments at bargain prices.

3. Minimize Debt: Lighten Your Financial Load

Debt can feel like a heavy backpack weighing you down on a long hike. When everything’s going well, you might not notice it too much, but when the path gets steep—like during a recession—that extra weight can really slow you down.

If you have high-interest debt, such as credit card balances, now is the time to pay it down. High-interest debt can quickly spiral out of control during a recession, especially if your income decreases. The goal is to reduce your financial obligations so that you have more flexibility and less stress.

If you have other loans, consider refinancing them to lock in lower interest rates. This can reduce your monthly payments and free up cash that you can use to bolster your emergency fund or invest in other opportunities.

4. Focus on Income Stability: Secure the Foundation

Your income is the foundation of your financial house. When that foundation is shaky, everything else is at risk. In a recession, job security becomes a top priority, and it’s important to evaluate how stable your income sources are.

Take a close look at your industry and your role within it. Are you in a sector that’s vulnerable to economic downturns? If so, it might be time to upskill or explore side hustles to diversify your income streams. The gig economy offers many opportunities to generate extra income, whether through freelance work, consulting, or even starting a small online business.

Diversifying your income isn’t just about making more money; it’s about protecting yourself from the unexpected. If one stream of income dries up, having others in place can help you weather the storm.

5. Invest in Recession-Resistant Assets: Find Your Safe Havens

When the seas get rough, it’s natural to seek out safe harbors. In the investment world, recession-resistant assets are your safe havens. These are investments that tend to hold their value or even appreciate when the economy takes a hit.

Gold and precious metals have long been considered safe bets during times of economic uncertainty. They serve as a hedge against inflation and currency devaluation, making them a valuable part of a diversified portfolio.

Real estate is another asset class worth considering. Properties that generate rental income, particularly in markets that are less affected by economic cycles, can provide steady cash flow even during a recession. Look for real estate investments that offer stability and long-term growth potential.

6. Monitor Economic Indicators: Stay Informed and Ready to Act

Knowledge is power, especially when it comes to navigating a recession. Keeping an eye on key economic indicators can give you a heads-up before the storm hits and help you make informed decisions about your investments.

Pay attention to GDP growth, unemployment rates, and central bank policies. These indicators can provide valuable insights into the health of the economy and the likelihood of a recession. While you can’t predict the future, being aware of economic trends can help you prepare for what’s to come.

Market timing is notoriously difficult, but staying informed allows you to make better decisions about when to buy or sell assets. If you notice signs of an economic slowdown, you might decide to adjust your portfolio, build up cash reserves, or explore new investment opportunities.

7. Consider Dollar-Cost Averaging: Invest Steadily Through the Ups and Downs

Imagine planting a garden where you add new seeds each week, regardless of the weather. Some weeks, the conditions are perfect, and the seeds flourish. Other weeks, it’s stormy, and growth is slower. Over time, though, your garden thrives because you’ve consistently planted and nurtured it.

Dollar-cost averaging (DCA) is like that steady gardener’s approach to investing. By investing a fixed amount of money at regular intervals, you spread out your investment purchases over time. This strategy helps you avoid the pitfalls of trying to time the market perfectly—something even the experts struggle with.

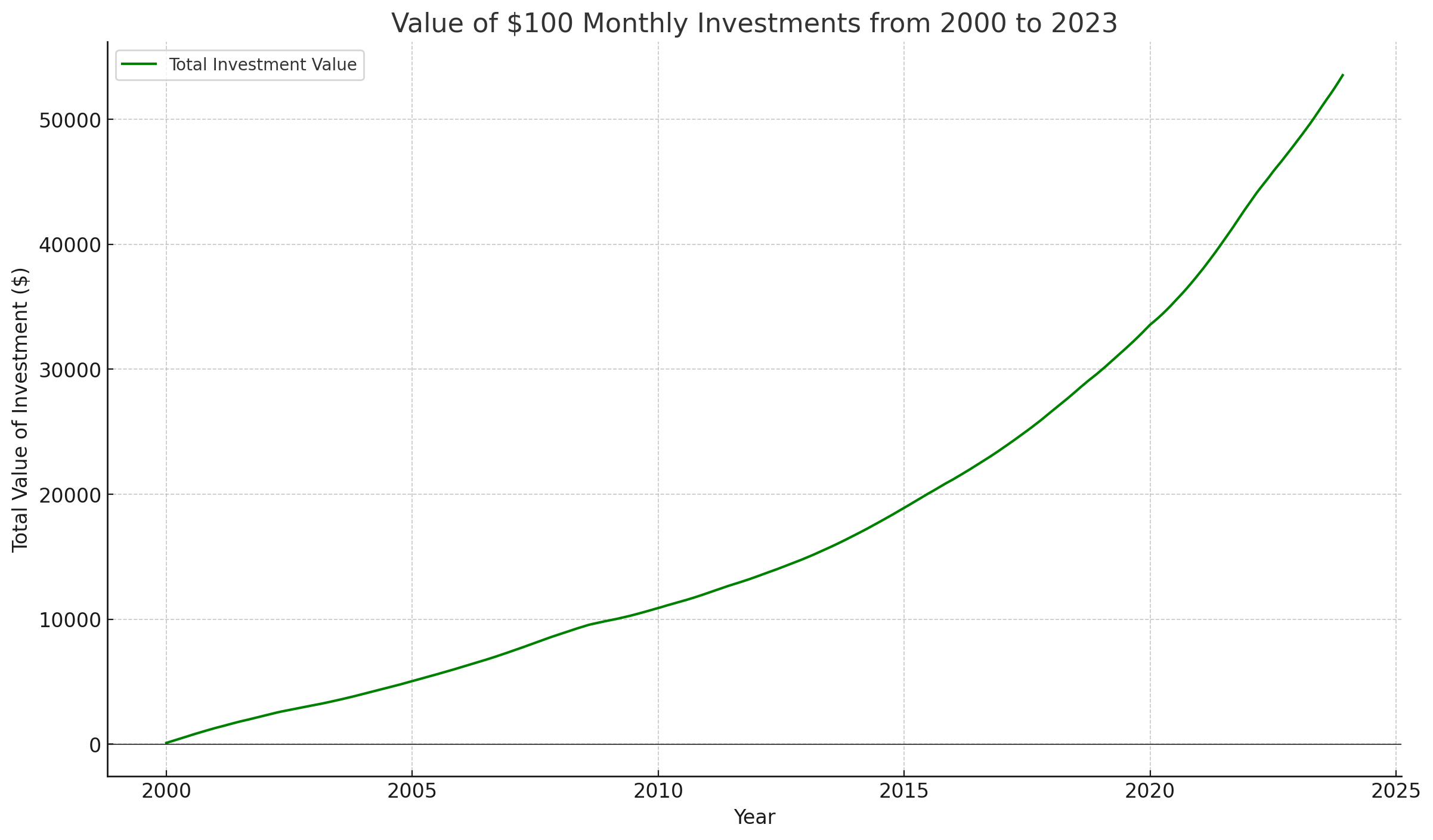

Figure 1: a figure using real monthly gain or loss data from 2000 to 2023

When the market is down, your fixed investment buys more shares, and when the market is up, it buys fewer. Over time, this can help smooth out the volatility and potentially lead to better returns. DCA is a disciplined approach that can be particularly useful during uncertain times.

8. Explore Alternative Investments: Think Outside the Box

During a recession, thinking outside the box can open up new opportunities. Alternative investments—like peer-to-peer lending, commodities, or even cryptocurrencies—can offer diversification benefits that traditional assets might not.

Peer-to-peer lending platforms allow you to lend money directly to individuals or small businesses, often with the potential for higher returns than traditional bonds. However, they also come with higher risk, so it’s important to do your homework and not overextend yourself.

Commodities like oil, agricultural products, or precious metals can provide a hedge against inflation and offer diversification beyond stocks and bonds. Cryptocurrencies are another option, though they are highly volatile and should be approached with caution.

These alternatives aren’t for everyone, but if you’re comfortable with the risks, they can be a way to diversify your portfolio and potentially increase your returns.

9. Protect Your Health and Insurance: Safeguard What Matters Most

In tough economic times, your health and well-being become even more critical. Medical emergencies or accidents can drain your finances quickly, especially if you’re not adequately insured.

Make sure your health insurance coverage is up to date and sufficient to cover potential medical expenses. This isn’t the time to skimp on insurance—think of it as an investment in your future security.

Disability insurance is another important consideration. If you’re unable to work due to illness or injury, disability insurance can provide you with a portion of your income, helping you maintain your standard of living while you recover.

By ensuring you’re adequately insured, you protect yourself from the financial impact of unexpected events, allowing you to focus on recovery without the added stress of financial worries.

10. Stay Calm and Avoid Panic Selling: Keep Your Eyes on the Horizon

When the market starts to tumble, the instinctive reaction for many is to sell everything and cut their losses. But history has shown that panic selling often leads to locking in losses and missing out on the eventual recovery.

Recessions are temporary, and markets typically rebound over time. It’s important to keep a long-term perspective and avoid making hasty decisions based on short-term market movements.

Instead of reacting to every dip, consider your long-term goals and whether your current investments align with them. If you’ve built a diversified portfolio, there’s a good chance you’re already well-positioned to weather the storm.

If you’re feeling uncertain, consulting a financial advisor can be a smart move. They can provide personalized advice based on your unique situation and help you stay focused on your long-term objectives.