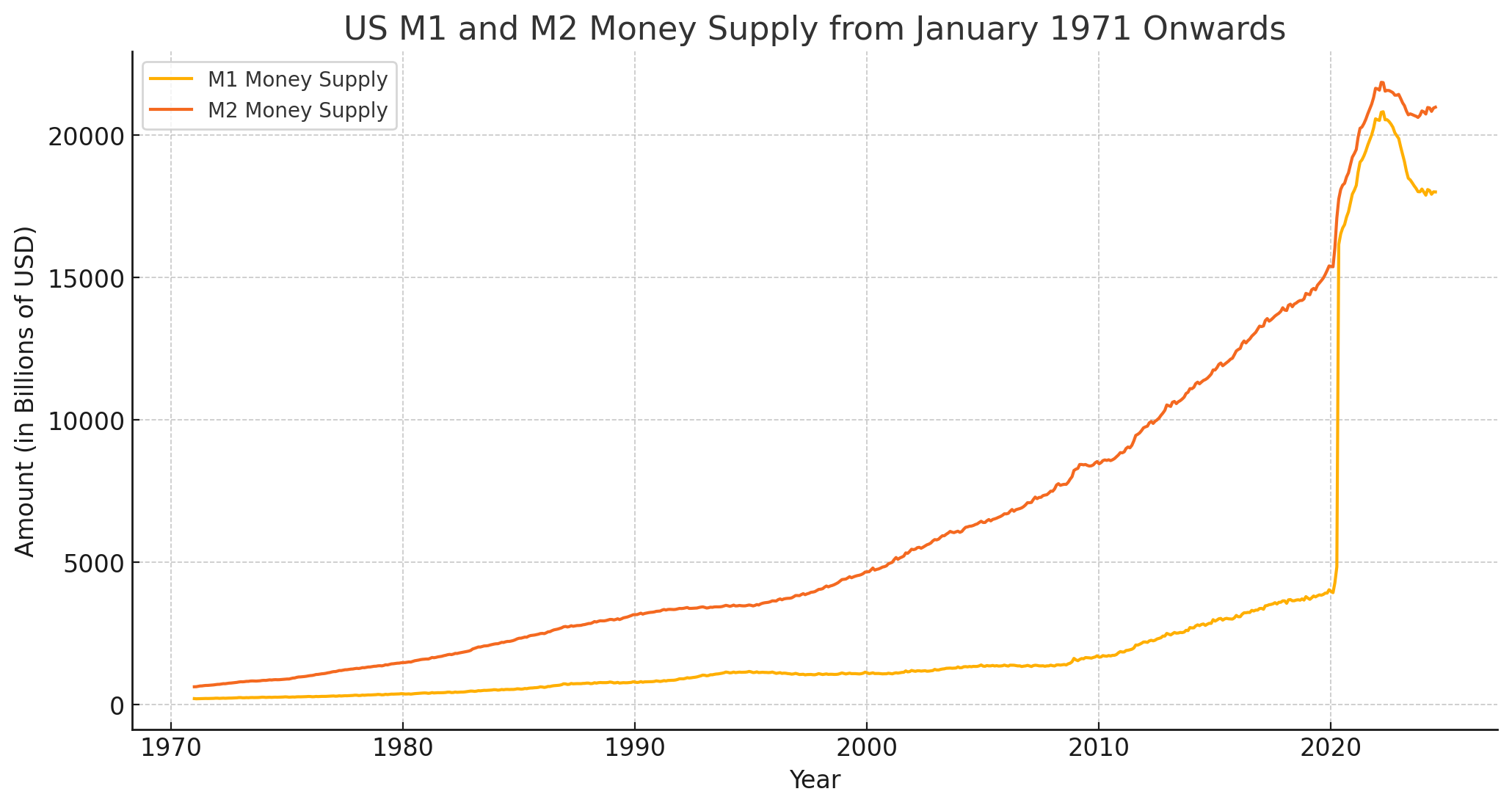

Since the onset of the COVID-19 pandemic, we've witnessed a remarkable series of events that have reshaped economies globally. Central banks, particularly the Federal Reserve in the United States, embarked on aggressive monetary easing policies. The intention was straightforward: stabilize the financial system and shield the economy from the catastrophic impacts of the pandemic. Interest rates were slashed to near-zero levels, and the money supply, quantified by metrics like M1 and M2, skyrocketed (Fig.1). However, the repercussions of these actions have woven a complex web that extends far beyond conventional economic relief.

Fig 1: M1 and M2 supplying from 1970 Jan. Source from federalreserve.

Stock Market: A Bull in a China Shop

Amidst these unprecedented increases in money supply, a curious phenomenon emerged. The stock market began to swell, reaching valuations that seemed disconnected from the underlying economic realities. While Main Street still reeled from lockdowns and job uncertainties, Wall Street was hitting record highs. This divergence raises a crucial question: where exactly is all this new money going?

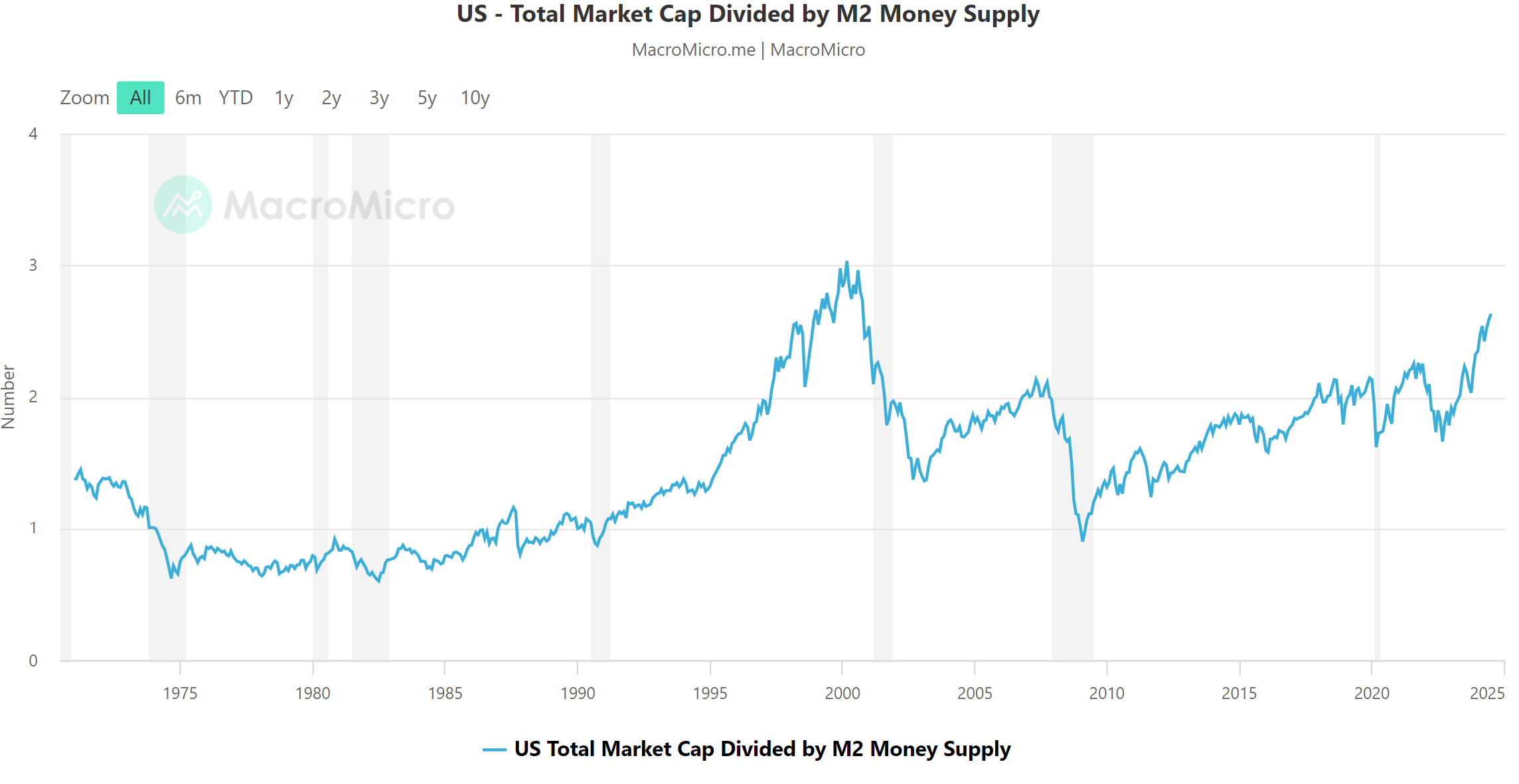

The ratio of the US total market capitalization to M2 money supply has surged, nearing historical highs. This metric provides a stark illustration that a significant portion of the monetary expansion has funneled into financial markets rather than the real economy. This is not just a statistic; it's a reflection of a broader economic anomaly where the abundant liquidity created by central banks is chasing a limited pool of assets, inflating their prices potentially beyond sustainable levels.

The Mirage of Wealth

This influx of money into the stock market has been a boon for those with existing financial assets. Their portfolios have ballooned, yet the real economy—a spectrum that includes small businesses, wage workers, and sectors like manufacturing and services—hasn't seen a commensurate benefit. This scenario exacerbates wealth inequality, as the gains from monetary expansion are disproportionately hoarded by the wealthy.

The Bubble Brews

The heightened stock market cap to M2 ratio (Fig.2), paired with an aggressive increase in money supply, points to a possible bubble. Traditionally, bubbles are characterized by asset prices rising far beyond their intrinsic values, fueled by exuberance and irrational market behaviors. Today, this seems to be facilitated by an overflow of cheap money finding its way into stocks, real estate, and other financial assets. The risk is palpable: when the fundamental disconnect between these soaring asset prices and the lagging real economy corrects, it could be dramatic and painful.

Fig 2: US total stock market Cap. / M2. Source from MacroMicro

The Conundrum of Correction

Central banks now face a policy labyrinth. Tapering these expansive monetary policies might trigger a market correction, potentially leading to financial turmoil. Conversely, continuing down this path could further detach financial asset prices from economic fundamentals, setting the stage for even more significant disruptions.

A Path Forward

Navigating this quagmire will require a judicious mix of monetary, fiscal, and regulatory measures. Directing capital flows towards productive uses—like infrastructure, technological innovation, and green energy—could be a step toward real economic enhancement. Additionally, regulatory measures should aim to curb speculative excesses and ensure that financial stability is not compromised for transient market gains.

In Conclusion

As we stand at this economic crossroads, the choices made today will shape the financial landscape of tomorrow. It's a moment that calls for critical examination and strategic action, not just by policymakers but also by investors, businesses, and consumers. The balloon of liquidity-inflated asset prices cannot ascend indefinitely—prudence, not exuberance, should be our guide.